A timely post for once, isn’t it?

We all know that trading has a negative effect on mental health for so many traders. And it doesn’t have to be crypto: Markets have been cornered way, way before crypto was even a gleam in Satoshi Nakamoto’s eye and there was always plenty of people on the wrong side of the trade.

So, trading is a stressful, competitive and cut-throat endeavour. You have to be able to handle the highs and lows of the markets in order to succeed.

But believe it or not, trading doesn’t have to be something that will make your life miserable.

If you’re miserable, quit

If the last sentence describes how you feel though, by all means, stop trading. There are easier ways to make money and keep them. Seriously.

In this blog post we’ll discuss some of the effects - bad and good - that trading can have on your psychology and mental well-being, so that hopefully the traders who enjoy trading can continue to develop their skills with no more setbacks than what’s necessary.

Can trading have good effects on your mental health?

One of the most asked questions Google will suggest to you on the topic of trading and mental health is How to overcome fear in trading.

Indeed, controlling fear and emotional responses in trading is a big issue. I personally think nobody can really teach you that. The matters of psychology are too individual for that.

But let’s first look at this fear that traders get. You’ll have to do some soul searching to figure this one out for yourself, but for the sakes of this post let me just make a blanket statement: In many cases it’s actually an adrenaline rush, not fear, what traders get.

A pretty normal response. Some people are wired so that it makes them happy, others will freak out; in any case it is not difficult to learn to control an adrenaline rush.

Why is this in under a headline talking about the positive effects of trading on mental health?

Controlled exposure to adrenaline is healthier than you think

While the term “mental health epidemic” has been well contested, psychiatrists still seem to agree that there has been an upsurge in mental health issues, especially in all sorts of trauma-related ones.

The standard treatment nowadays are coping strategies, which is something like a lame sister of affirmations, and then meds of course. Some psychiatrists criticise that and propose what is basically a systematic exposure to stress, anxiety and adrenaline. There seems to be some neurological research to back that up.

According to Judith Herman, M.D., author of Trauma and Recovery: The Aftermath of Violence from Domestic Abuse to Political Terror, this practice teaches people to analyse their experience with adrenaline first, before freaking out.

Here’s your Bitcoin killer app, I think.

You still need a trading strategy though

Let’s now go through some of the more practical tips.

Controlling an adrenaline rush doesn’t mean erasing it. It means you just carry on doing whatever you planned to do, aware that you are also having an adrenaline rush.

It’s whatever you planned to do, let’s repeat it for the people in the back. If you do not have at least a super basic plan, adrenaline is not going to help you.

-

Risk management

Risk management is a practice through which you try to reduce the amount of risk in your trading by setting up rules for yourself when trading.

A good rule is the one that says nobody ever went broke by taking profits. It is better to take profits too early than too late. Nobody has the crystal ball, at best you can be fairly confident that you are right. It makes sense to “price” the alternative of actually being wrong.

- Close positions by 10% or 20% based on your targets. You can use this sort of plan even when you just DCA and hodl.

- Sell the altcoins that start to perform worse than the rest of the market - more in Market Timing Strategy.

- Use stops. You can use them as a functional part of your trading - more in Scalping Strategy.

-

Take a break regularly

There are ways day trading can make your mental health worse. The constant stress of the markets, even for those who are good at controlling their emotions, can cause problems with anxiety. A steady trader must learn to control their emotions, which isn’t possible without proper rest. Skipping rest eventually leads to burnout.

There are a few things you can do to avoid burnout in trading. You can start by being aware of your responsibility for your profits. If you have a losing streak, remind yourself that it’s not because the markets are rigged against you, but rather because you’re missing some key information.

- What is it that you didn’t consider?

- And what are the things you did consider but chose to ignore?

This will give you the motivation needed to try new strategies and make changes to your trading habits.

-

Do not make trading more emotional than it has to be

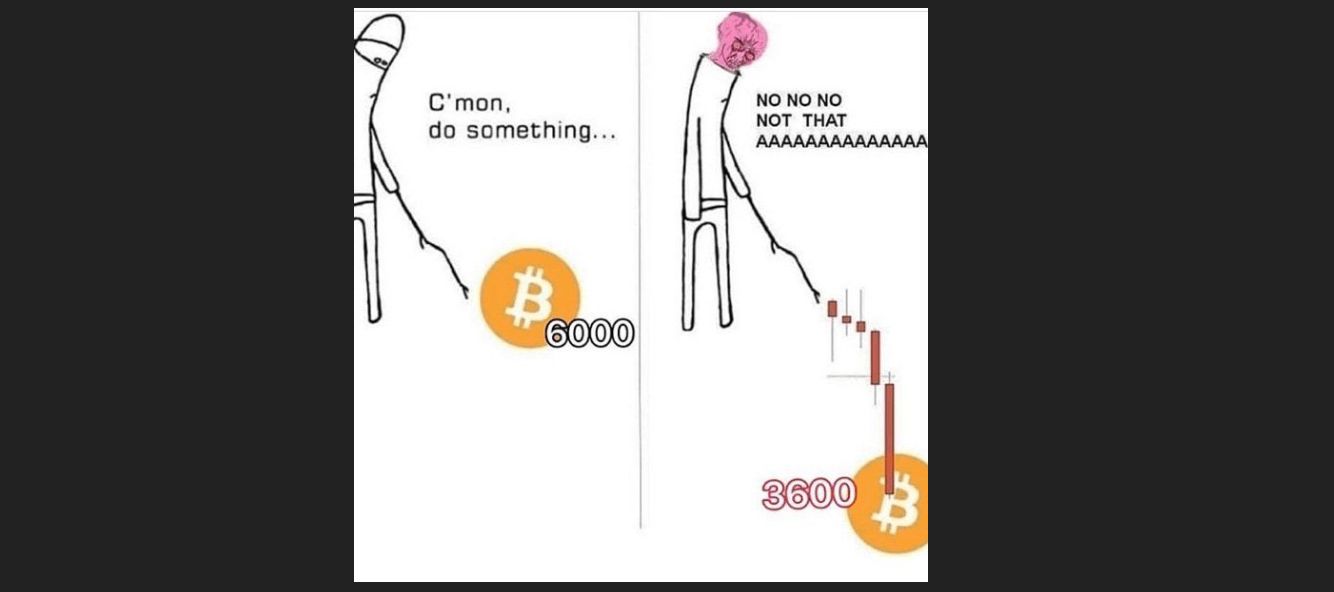

A person must learn to control their emotions when it comes to financial decisions because overreacting could cost a lot of money that in the worst case he doesn’t even have.

The following are three major things that keep you organized in a way to help your control your emotions when trading:

- Reviewing your trades before you go to sleep for the evening. Using a trading log is a good idea. It can be a simple Google Spreadsheet.

- Have a dedicated block of time for analysis. Look at the charts, read the news, skim the message boards, make notes. Don’t just do that whenever you feel like procrastinating.

- Identifying emotional triggers at their source. For example, if watching the market all day makes you feel anxious, stop watching it! Submit your orders and go do something else.

- Allowing yourself time off from trading when you feel like your emotions are getting out of control.

-

It’s just trading

When you’re having a bad day trading, remember that it’s just trading. It’s not your life. You can always come back tomorrow and try again. The markets are not going anywhere.

Bottom Line

You may have been asking yourself if trading is bad for mental health. There is no simple answer. But it is safe to say that well-handled crypto trading has more psychological benefits than it has drawbacks.

It is likewise safe to say that it does take discipline to trade successfully though. Disregarding at least rudimentary risk management is a sure way to fail.