Bitcoin is over ten years old now, but there are still plenty new people buying their first ever crypto.

Inevitably, the first question of a newbie crypto investor will be: Can you buy a small fraction of bitcoin? Or a fraction of Ethereum?

- The answer is yes, you can absolutely buy a tiny fraction of a cryptocoin.

Once you get into the practicalities of doing that, another question will come up:

Can you buy a fractions of bitcoin without getting ripped off on fees?

- The answer is again - yes. But you will need to do some due diligence.

This article is here to help you with that.

How to buy a tiny fraction of bitcoin or altcoin (less than 10 USD)

Back in the day, you would use a bitcoin ATM to buy small fractions of Bitcoin. And that’s a fair choice if you want to buy just once. If you want to make that purchase a regular affair though, your bitcoin ATM fees will soon add up.

This is a list of crypto platforms on which you can buy small fractions of cryptocurrency with fairer fees that crypto ATMs.

- Platforms are rated based on how friendly they are towards small crypto purchases.

- Other than the minimum fraction limit, we also rate their fees and whether you can withdraw the crypto you bought.

- We ordered the onramp platforms from the best to the worst.

1. Buy a fraction of BTC at Large Regulated Custodial Crypto Exchanges [THE BEST]

- Minimum traded size ~ 1 USD on some exchanges, on some markets

- Trading fees 0.1-0.5% (negligible for small traders)

Regulated crypto exchanges are the most cost-effective way to buy small fractions of cryptocurrency.

The transaction fees are low, the price of the coin is its true market price and you can deposit or withdraw crypto whenever you want.

Minimum order size is most typically 10 USD/AUD/EUR/GBP for BTC markets.

- On smaller altcoin markets the minimum order size may be higher than 10 USD.

- At the Australian Independent Reserve, minimum order size is

1 AUD/NZD/USD/SGD. Fees are high but for tiny orders they won’t add up - and at least you can actually buy.

Other trusted Crypto exchanges are Kraken, Gemini and Binance.

Cons of buying at a large regulated exchange

- You will need a bank account. Choose an exchange as local to your banking network as possible, else you’ll get extra fees.

- US: Kraken, Gemini

- EU: Kraken

- AU/NZ: Independent Reserve

- Singapore: Independent Reserve

- East Asia: Binance

- Withdrawals from the exchange into your wallet can be expensive. The withdrawal fee will rarely be below 10 USD for BTC or ETH right now.

- If you want to avoid losing that much money, leave the money at the exchange.

- Independent Reserve and other regulated exchanges offer cryptoasset insurance for a small yearly fee.

- Binance, Bitfinex and other exchange offer on-platform staking where your cryptocurrency wallet earns interest simply for leaving it on the exchange

2. Buy a fraction of BTC at P2P Marketplaces

- Minimum traded size ~ 5 USD

- Low fees, but price above the market (you will pay extra ~2% in total)

- No need to withdraw, if your P2P app gives you the private key to your account (you save withdrawal fee and money spent on Ledger wallet)

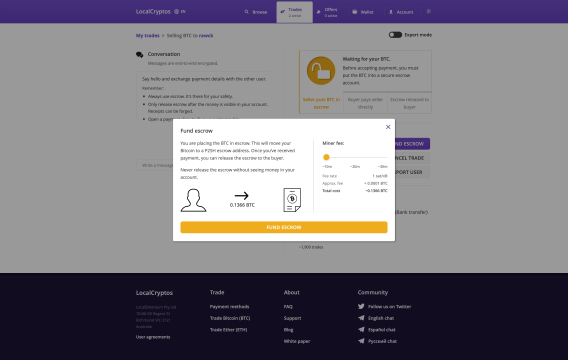

The current top p2p marketplace is called LocalCryptos.

The pros of buying a fraction of crypto on LocalCryptos should be pretty clear:

- LocalCryptos is a zero-knowledge decentralized app. The owners of the marketplace have zero information about its traders and zero access to the user wallets.

- The marketplace runs on smart contracts, again without any access of owners or admins (BTC and LTC blockchains do support a much simplified version of “smart contracts”.)

- No KYC is required, no bank account is required. You can buy for cash by meeting someone in person.

- LocalCryptos already is a wallet. Your account comes with private keys that only you know. You don’t need to withdraw crypto from there, but you can do so if you want to.

Cons of buying from a P2P marketplace

Using a marketplace like LocalCryptos still requires at least basic understanding of blockchains and the related technology.

3. Buy a fraction of BTC at a Bitcoin ATM

- Minimum traded size ~ 10 USD

- Crazy high fees (5-10%)

Asking around on social media, you will find that surprisingly many people still use Bitcoin ATMs to purchase fractions of bitcoins.

There is nothing wrong with that, except the outrageous fees. Bitcoin ATMs charge anything between 5-10% transaction fee.

- If you just want to make a small one off purchase with some cash, don’t sweat it and use the ATM. Here’s our guide on how to use a BTC ATM

- If you buy regularly, do that on a crypto exchange or a p2p marketplace.

Cons of buying from a crypto ATM

Even if you only literally have pocket money to spend on crypto, over time the fees will add up.

4. Buy a fraction of BTC via Revolut app [THE WORST]

- Minimum buy is super low

- Fees are super high

- You cannot withdraw your crypto

Among beginners, Revolut is a popular way to buy crypto. Sadly, except convenience, it has the worst of everything.

Once you get a Revolut account and get verified, buying crypto is basically 2 clicks away.

The fees are high though, and you will never be able to withdraw your crypto. Nor you own any private keys, if there are any private keys at all…

Revolut’s version of crypto works mostly as a contract for difference: You can buy and sell to generate profit in fiat currency, but you cannot buy crypto to use it as money.

More about buying crypto on Revolut

Summary

- Buying small amount of crypto on a non-custodial marketplace is easy enough and still cheap.

- Minimum purchase amount on custodial exchanges can be as low as 1 USD, but you might get hammered on transaction fees.