Are you tired of feeling like you’re always playing catch-up with the latest alt coin hype? Or are you the cautious type when it comes to investing? Do you stick to low-risk crypto assets, or do you dabble in low-cap alt coins?

If you’re looking for a way to keep your risk and improving your potential returns at the same time, it might help to consider risk diversification and risk budgeting.

What is risk diversification (and what it isn’t)

Risk diversification is a strategy that seeks to improve your risk-reward ratio by investing across a variety of different assets.

Risk diversification is not strictly about lowering your risk, though: It is a technique that aims to maximize returns for a given level of risk.

It is used extensively in most forms of financial risk management. In 2025, that also includes the world of cryptocurrency.

Risk diversification relies on the fact that not all risk factors are correlated with each other.

-

Within your crypto portfolio, you can diversify your risk by spreading your investments between asset types that are starting to live their own lives.

That is: dinosaur cryptocurrencies, smaller volatile alt coins and any of the newer products (DeFi, NFT).

Note that for some long-term holders this part will actually increase to risk.

-

To further diversify the risk of your overall portfolio, add some non-crypto investment.

Spread your investments between stocks of companies of varying sizes, over different industries and over a range of geographic regions.

This element will lower the risk of your portfolio.

-

Neither point 1) nor point 2) aimed at creating a hedge for your portfolio.

As for risk hedging, think about a black swan type of event for which you’re offsetting the risk. Hedge is employed for a limited time only, to protect you from a catastrophic event.

The bad news is that hedge usually requires market timing. The alternative is a portfolio-wide stop loss, a common strategy on auto-trading platforms that you can set and forget. More on hedging a bit further down.

When to consider risk diversification

Your crypto portfolio could possibly use risk diversification …

- if you are over-exposing yourself to one particular area

- if you are making subpar profits for your risk appetite (either through trading losses or through not risking enough)

- … or both at once

Since risk diversification is all about risk management, it needs to be used as a tool to help you achieve your goal of making risk-appropriate gains.

You may want to increase your total risk, too!

Example: Same portfolio, different trader

For illustration, let’s taken an example portfolio of a crypto holder:

- 75% ETH

- 20% fiat

- 5% in ETH-based NFTs

Is this an over-exposed portfolio? It is - there is no way around that.

A basic way to find out whether your portfolio is over-exposed is to compare a chart showing your portfolio’s value with the charts of the assets you hold.

If you are over-exposed, the movement in your portfolio value will be following the value of one asset or one group of assets.

- The example portfolio will be highly correlated with ETH. The NFT trading will make dents there, but not consistently enough. Also consider that since they are ETH NFTs, they are still somewhat correlated with ETH.

“Over-exposed or not” is as far as objective thinking will take you.

You may be comfortable with the over-exposure, or you might not.

There’s no rule or table for that, it all depends on your risk tolerance.

Enter Risk Budgeting

There is a risk management technique called “risk budgeting” which works with risk tolerance.

In risk budgeting, risk is based on volatility. You essentially rebalance your portfolio according to the size of the loss you are willing to take in a drawdown. Which, by the way, is a good habit to build, because you are evaluating your trading decisions with the risk-reward tradeoff in mind.

Let’s return to the example portfolio - 75% ETH, 20% fiat and 5% ETH-based NFTs - and the possible risk budgeting scenarios different traders might consider.

-

Not happy with returns: Too much money on the sidelines

AKA not enough risk in the risk budget. Some investors are aggressive and want to see the gains they feel are appropriate to being in crypto.

Here, the aggressive trader will be tempted allocate more of their portfolio into NFTs. NFTs are still super high-risk as the market is very young and not structured enough for any systematic speculation.

That’s OK for risk budgeting, but looking at it with risk diversification in mind, a better alternative may be to invest in DeFi alt coins instead or to get some high-leverage trading done.

This way the portfolio gains added risk, potential profit also increases, but at the same time the portfolio will not be too exposed to the whims of NFT shills.

-

Happy with returns, not happy with risks: No limits to losses

Other investors would take comfort in knowing that in the “worst-case scenario”, their portfolio can only be down, say, 10% in its dollar value.

AKA, the risk is too high.

There is a few things you can do, and the easiest one of them is to set a portfolio-wide stop loss. Not to sell just yet - you still want those crypto-only gains - but to sell if the markets start dropping.

Shrimpy lets you do that automatically with no coding, as long as you hold your crypto in a wallet.

Portfolio stop loss has a limitation though: If you are staking your crypto, you will need to use derivatives by way of a hedge, as the actual coin might not be available for you to sell when you need to.

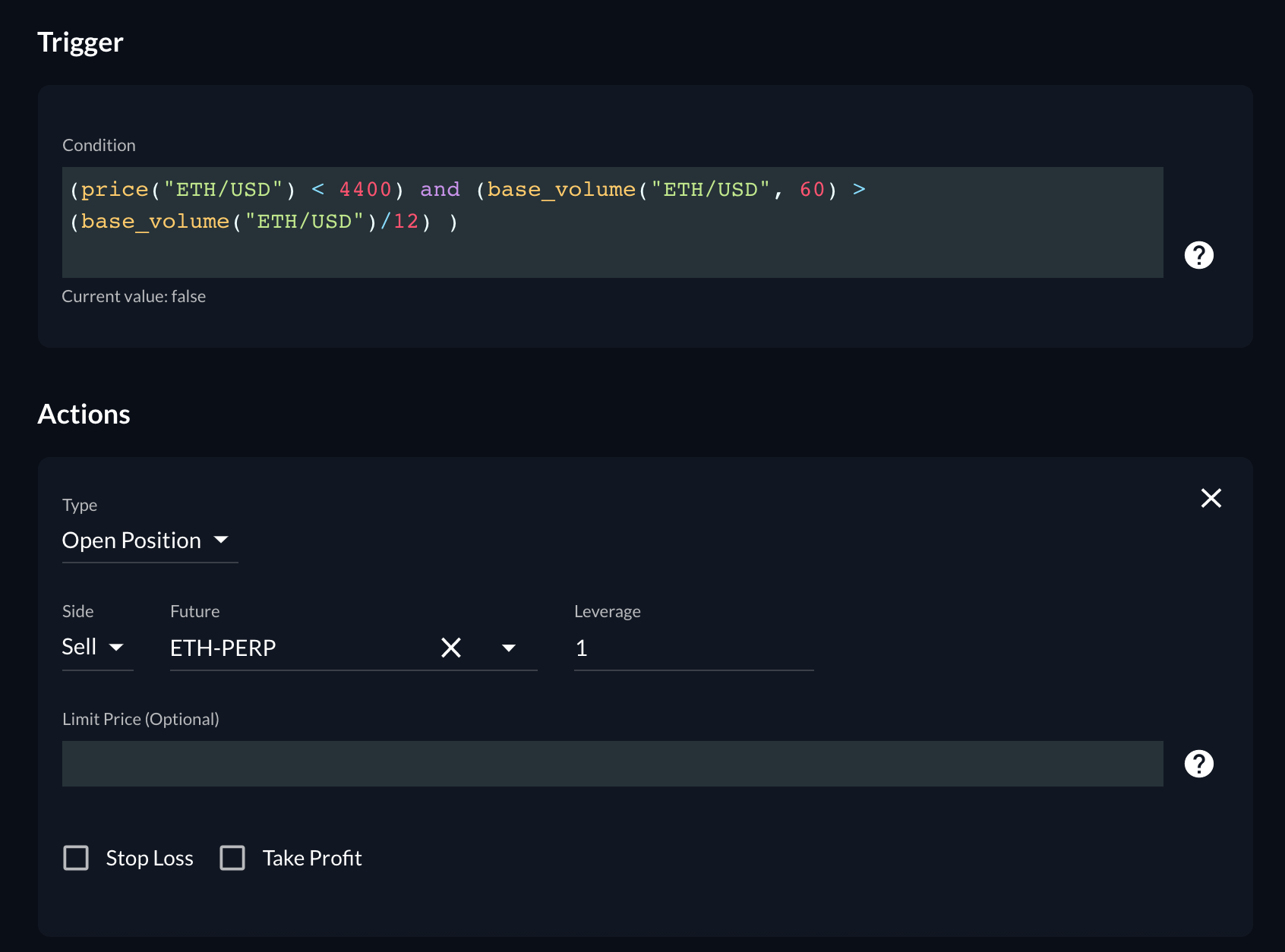

The best way to do that at the moment is to set up triggers to open shorts in the FTX Quant Zone. The Quant Zone a quite a bit less user-friendly than Shrimpy.

-

Happy with risks of crypto, but: Just too ETH-focused

A trader who is happy with the level of risk but not with the over-exposure to ETH obviously needs good old portfolio diversification.

The trick to diversify while keeping the level of risk roughly the same is in adding some assets that increase the overall risk as well as other assets that will lower it.

In the example portfolio, stocks or real estate would lower the risks and small alt coins would increase it. Depending on your successes there, your overall profits might increase.

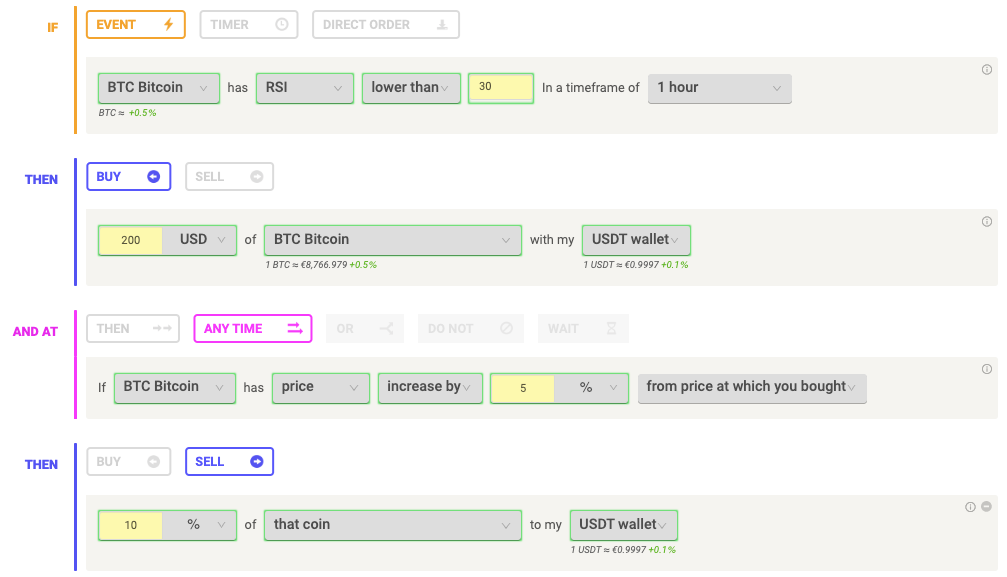

If you don’t mind technical alt coin trading, you could set up a Coinrule bot for your low-cap alt coins to buy on some generic signal like RSI, and sell at 10% profit.

-

Not quite happy, but also not willing to guess and speculate

Yet others may feel that hedging and rebalancing is equivalent to timing the market.

And that is out of the question as they want to focus the long term.

There are still ways to diversify risks without timing anything - more on that in the next section.

Risk diversification when you don’t want to speculate

Risk diversification principles are pretty versatile.

You can still diversify risks even when there are too many unknowns and the risk factors keep changing: for example, during times of market turbulence.

Professional analysts usually find it difficult to estimate future risk in those times.

But you as an individual investor have the freedom to solve this problem in a lateral way: Investing in a business project or indeed starting your own business may do that.

Choosing an unrelated industry for that will improve your risk diversification even better.

Either way, this is a better way to risk diversify than by selling crypto to wait with fiat on the sidelines.

The difficulties with diversifying risk in crypto

As a final note, the difficulty with crypto risk management is not actually the correlation between alt coins.

It’s rather that there are so many risk factors involved with each crypto, and new risk factors are constantly being developed.

- For example, the risk profile of Bitcoin changed when it became possible to trade BTC futures on unregulated exchanges with high leverage.

- Some time after that, the risk factors changed again as institutional players entered the crypto markets.

Some investors may decide that hedging risk is too expensive, either in terms of fees, time or opportunity costs. That is a valid decision. In this case, the reasonable thing to do is to research thoroughly and not invest more than you can survive losing.

If your problem with risk diversification is the time it consumes, try to automate your rebalancing and hedging, and use a stop loss. You won’t go broke taking profits.

- Shrimpy (30% off from here!) specializes in portfolio management automation

- Coinrule specializes in easy to automate technical trading

Bottom line

Risk diversification is not just hedging or in other ways trying not to lose. It is about choosing which risk factors to invest in (such as small cryptocurrencies or NFTs) and which ones to pass.

This way you can capture much higher returns than by playing it safe, but by limiting your high risk investments to small part of your portfolio, making the wrong bet would not damage your net worth too much.