IMPORTANT! BitMEX platform is no longer recommended since mid-2020.

- For futures trading, use Bitfinex (no KYC, 6% fee discount)

- For perps and crypto options, use Deribit (easy KYC, 10% fee discount)

Why is Bitmex no longer a good place to trade

Up until August 2020, BitMEX was your trusty exchange where no KYC was necessary and you could access the exchange even from Tor or VPN - it breached the TOS but compliance was not enforced, as was the custom.

In August 2020, BitMEX announced they will be requiring KYC from all users starting 28 August 2020.The KYC procedure includes government documents, selfie and a questionnaire. As a reminder BitMEX does not serve US traders.

- 2021 BitMEX no-KYC alternative is Phemex exchange. Based in Singapore, no KYC required, new in business though.

Just here for the BitMEX promo code?

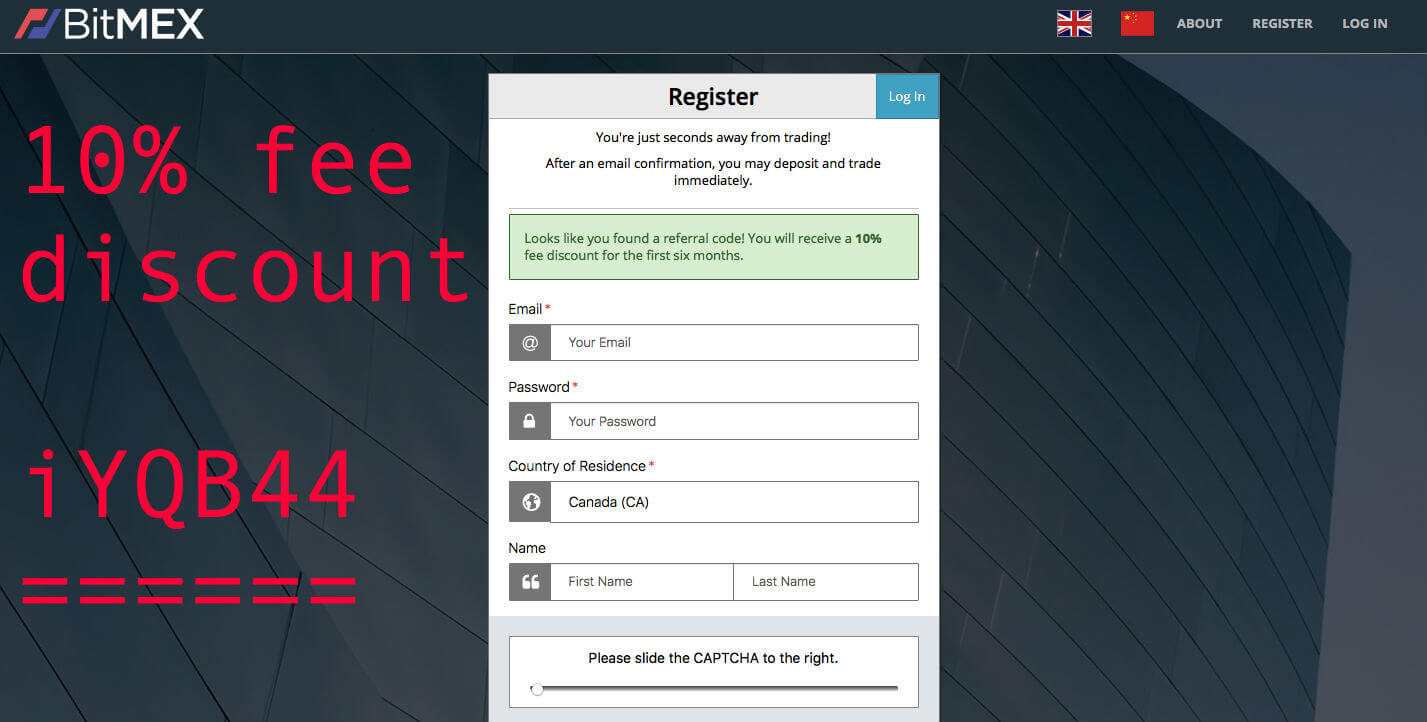

BitMEX users who sign up at BitMEX with referral code iYQB44 get 10% fee discount for 6 months.

bitmex.com referral code iYQB44 for 10% FEE OFF

For which trading methods is BitMEX best for?

For examples of trading techniques suitable for BitMEX, see Scalping Crypto or TensorCharts. Yes, it’s mostly short term speculation.

Related Articles:

Crypto Trading Strategies Suitable for BitMEX

Crypto market psychology vs *your* trading psychology

The crypto market psychology is what it is for a reason. If that makes you uncomfortable, try working on your trading psychology.

More About BitMEX

BitMEX is a cryptocurrency derivative platform. You cannot buy altcoins or bitcoin on BitMEX with your national currency, you can only trade their products for profit. You get your winnings paid out in BTC.

Currently the most traded products are BTC futures, ETH futures and BTC perpetual swap (derivative mimicking spot BTCUSD market).

In addition to that, BitMEX sometimes opens betting on upcoming events in the crypto markets - the betting market for the COIN ETF was up in February 2017.

- Leverage is dynamic between 1x and 100x. Trade with caution, overleveraged traders cause margin cascades on BitMEX.

- Fees are changeable - depending on the market and on some also whether you’re long or short. (see our short explainer of Perps)

- Derivatives have a mark price based on Coinbase, Bitstamp and Kraken spot.

- The dynamic way of perpetual swap funding makes it possible to trade non-speculative positions that will only earn from funding payouts, but vast majority of BitMEX traders come for short term speculation.

BitMEX and US Customers

BitMEX does not serve US customers. However, the exchange is accessible from a VPN or from the Tor network.

If you are US-based trader looking for high leverage, you have the following options:

- Move on to non-custodial leveraged trading

- Use a VPN to trade on platforms that still don’t require KYC.

Traders based in United States are restricted to trade on Bitfinex, but KYC is not yet required on that platforms.

Deribit started requiring KYC on 9 November 2020.

Get 10% fee discount on BitMEX