Key Points / Sideways Market

-

Ranging markets are in a sideways “trend”.

-

Ranging market is a market that is in fact lacking a trend of direction.

-

Sideways market is not bullish (not consistently marking up) nor bearish (not consistently marking down).

-

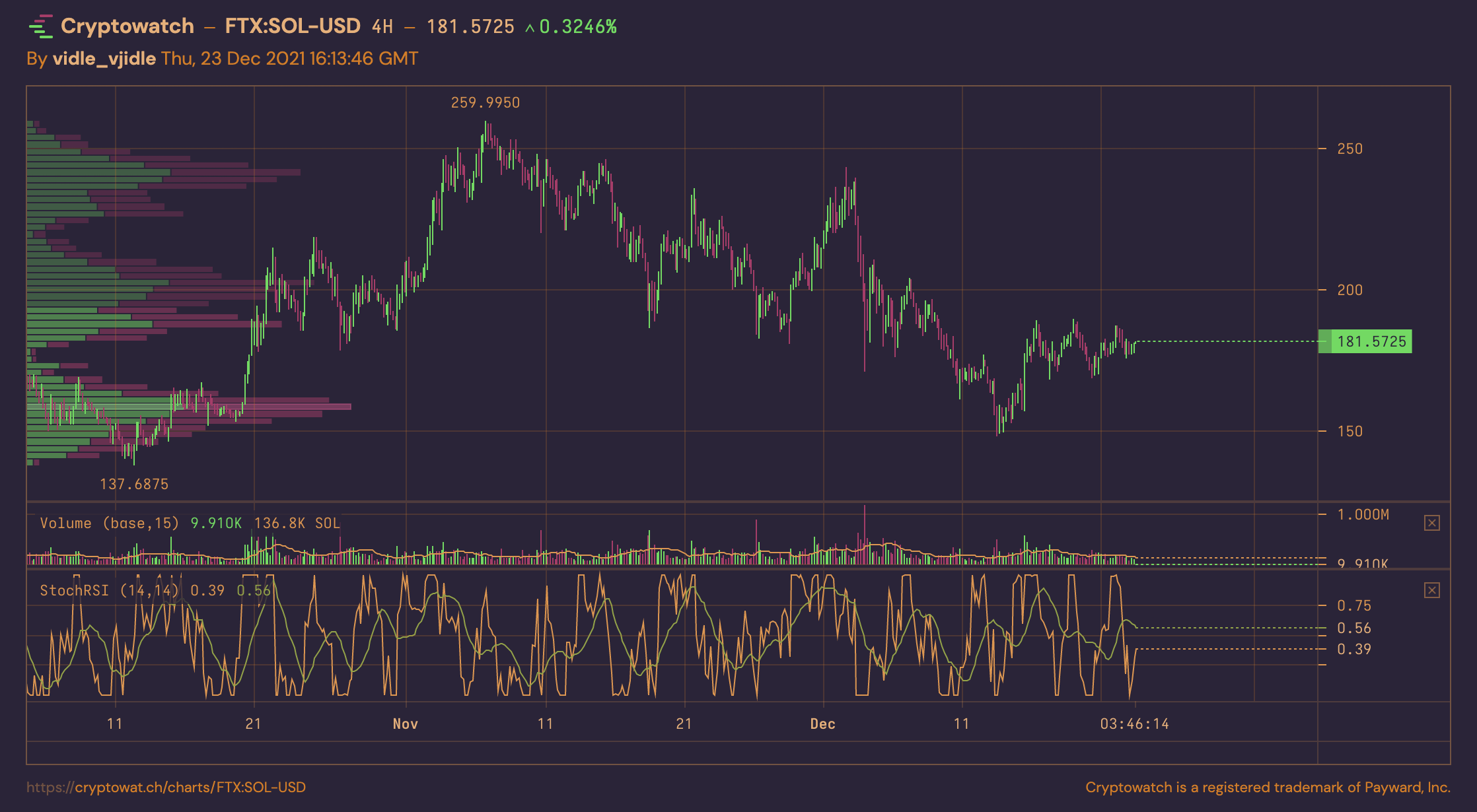

Tools for Sideways Market: #tradingview

Alternative names for ranging market

Ranging market is also called the sideways market.

How to trade a ranging market

In forex or other markets where very short term trading is common, people like to scalp the market - closing their positions after only few minutes, raking small profit.

Be warned though, because in cryptocurrency, even in Bitcoin, the liquidity is sometimes not good enough to do that properly.

Best Tools for Sideways Markets

- Trading Platform: BitMEX

- Technical Analysis: Wyckoff, Support/Resistance, Boxes

- Charting App: Tradingview

Trading Techniques for Ranging Markets

One of the old but still well fitting descriptions of a typical ranging market can be found in the Wyckoff method. The Wyckoff method is focused on longer term trades and the crux of the range trading is the identification of the phase in which the market is.

A market can be ranging because there is an accumulation or reacummulation going on, after which a bull trend follows.

Alternatively, a market can be ranging because there is a distribution starting, after which a bear trend follows.

An indepth look at Sideways Market is here.