Automated trading can be a gold mine, if done well. There are traders who have a well set-up and backtested bot for scalping their favorite crypto market, and they run it whenever the market is ranging to save up their limited attention for more profitable situations.

But sometimes all you need is just a simple programmed buy order based on a few conditions, so that you don’t have to spend two months babysitting the charts when all you want to do is a spot buy on a decent bounce.

Well, turns out that in 2025 some crypto trading platforms let you do that natively. Not only there is no need to write code, there is no need to get a third party tool either.

Different trading platforms offer various degrees of complexity in what you can automate.

We’ll start from the most easy to use solution here.

Also read about these crypto programs if you’re interested to learn about some interesting affiliate networks.

Auto Trader on Independent Reserve

The AutoTrader feature on the Aussie exchange Independent Reserve is very simple, but good rnough for most of your non-degen pursuits. Independent Reserve itself is an exchange built mainly for fast and legitimate onramp and offramp between cash and bitcoin or altcoins, not for daytrading and scalping.

But what it can do it does very well, and it will make your DCA or diversification work easier.

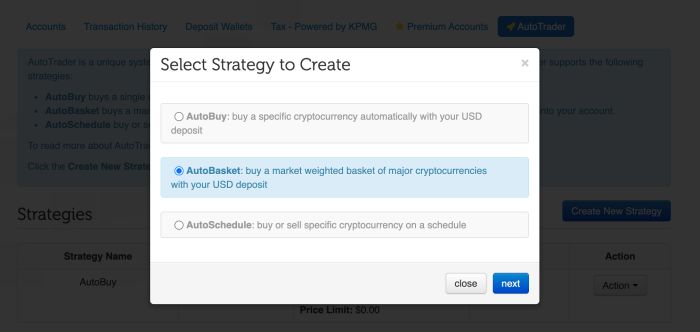

The AutoTrader is a free, user-friendly feature that currently has the three following strategies live:

- Auto Buy on Deposit: Automatically buy or Dollar Cost Average (DCA) your way into bitcoin or altcoin once a fiat deposit is credited to your account.

- Auto Basket for Diversifying: Automatically buy a weighted basket of cryptocurrencies once a fiat deposit is credited to your account.

- Audo Schedule: Scheduled buying or selling of cryptocurrencies on a regular schedule. You can deposit once a month and then run the auto schedule to DCA parts of that deposit on regular intervals.

You will find the AutoTrader in your Accounts section at Independent Reserve. Supported fiat currencies are AUD, NZD, SGD and USD with fast deposits and withdrawals worldwide.

Sign up More about Independent Reserve

FTX Quant Zone

FTX Quant Zone is where you can natively automate your crypto trading based on quite a lot of parameters.

You will need to set up your rules in pseudo-code, but you will find they are easy to work out. Nonetheless: The FTX quant zone gets confusing for portfolio management where you handle a lot of assets, and for trading on technical indicators.

- Here are examples of third party trading bots for FTX

Volume trading on FTX Quant Zone

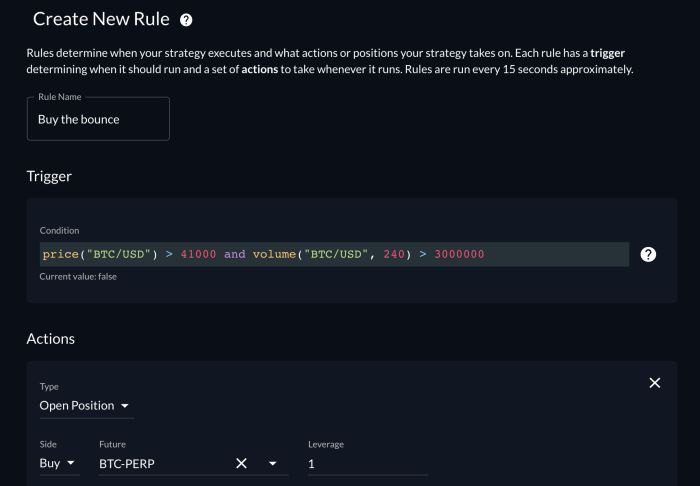

Here’s a simple rule that lets you buy a high volume breakout:

- Another volume trading setup on FTX Quant Zone here in the VPVR trading strategy post

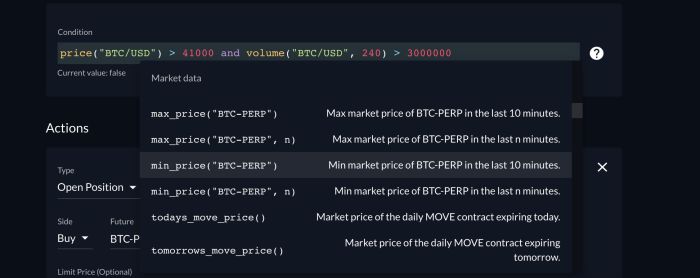

To add parameters, click the question mark icon next the rule field. You’ll get the manual with all of the rules that are currently implemented.

Market timing on FTX Quant Zone

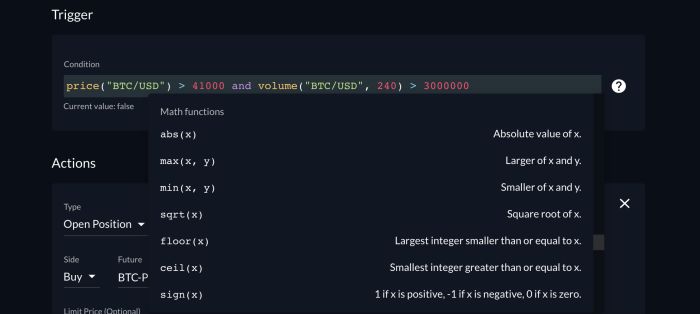

Not only you can program a trigger based on how much and on which volume a market moves within any time period of your choice, but you can also build your own stats if you want to.

There is a full library of basic arithmetic operators implemented. I am sure it will be painstaking if you’re not used to working with low level commands, but with a little bit of trial and error you can build triggers for basic TA metrics. You just need to google the formula on which they are built or copy and adjust it from a TradingView pine script.

It is worth pointing out that the market on which you set up your trigger does not need to be the same as the market on which you execute your order.

- A simple example: Let’s say, you own BTC, you want to buy a BTCUSD bounce but you also want to limit your potential losses in case you’re wrong. In this case you could set up a trigger on the spot market and direct it to act on BTC perpetual swap with a stop loss, or you can direct it to buy a call option. FTX global does support options trading.

- A market timing example: FTX provides several basket indices to work with: You can trade on the comparison of a single market vs an index. More on that in market timing article.

- You could also work out a relationship between crypto and stocks, and direct the action to one of FTX’s tokenized stock markets…Tons of possibilities here.

Sign up (5% discount) More about FTX (US and Global)

Bitfinex

Bitfinex currently does not offer an automation tool for trading. They do offer two related products though:

- Lending PRO, which is an automated, rule based interface for offering of your Funding wallet balance on the lending market.

- Bitfinex Terminal which offers market data for serious algo backtesting at https://terminal.bitfinex.com/

If you lend fiat or crypto to other traders on the margin lending market, the Lending PRO interface is a good way to ensure your balance is utilized to the fullest.

The Lending PRO has a posh name but it’s available for everyone regardless if they are KYC-verified or not.

Dig in and test it for a bit to experiment with the rules on different lending markets. It costs nothing and it does not risk any more money than manual lending since your assets are already deposited in the funding wallet anyway.

As for trading though, Bitfinex only has products for advanced algo trading.

Sign up (6% discount) More about Bitfinex

Platforms that currently don’t offer automation

- The no-KYC/low-KYC mainstays Phemex and Bitforex.

- Binance, but they tend to implement features once they get popular on smaller exchanges.

- Deribit, although they do make automation easier by running an interactive position builder with PnL projection and their API is well documented.

- Bitfinex, in a simply ready-made way for trading.

With all these, you will need to use the Coinrule bot or some other third party bot builder for now.

Let’s hope crypto trading platforms will catch up and understand that traders have better things to do than staring at charts when they don’t have to.