DeFi and cryptocurrencies are innovations that have the potential to revolutionize the financial industry. The absence of third parties, anonymity, quick transactions - all this attracts users and arouses interest in cryptocurrency exchanges and decentralized systems. They radically change financial management and allow you to access money at any time of the day.

People are becoming more interested in DeFi and virtual assets. At the same time, users not only buy cryptocurrencies, but are also interested in how to create their own platforms. For example, the affordable cost of developing a cryptocurrency exchange from Merehead makes it possible to become closer to technology.

It is important to understand how DeFi and virtual asset platforms work to understand the full extent of the impact of these systems. This will help you not only stay on top of all changes, but also adapt to them in time.

What you need to know about DeFi

Decentralized finance (DeFi) is a technology that runs on secure, shared ledgers. The main idea of the system is to enable users to take part in transparent financial transactions without the intervention of intermediaries.

DeFi runs on the Ethereum blockchain. This is a secure system that guarantees a high level of protection of personal data and allows anonymous transactions to be carried out in a minimum period of time. The technology is available to all users who have Internet access.

DeFi and the Traditional Finance Industry

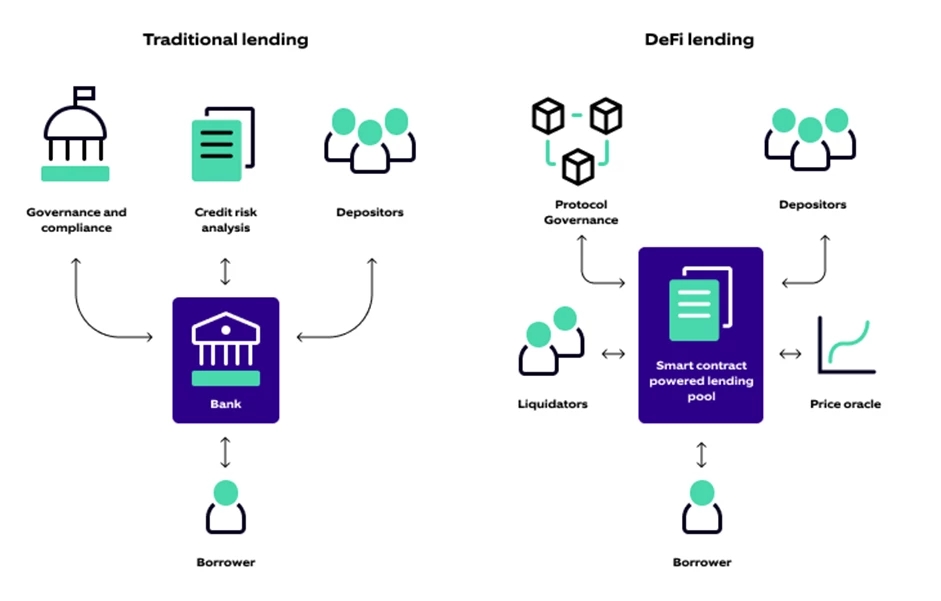

In the traditional financial industry, transactions are managed by intermediaries. These are companies and banks that provide services. In a decentralized system, all operations are controlled by algorithms. The code that controls DeFi is available to all users. This ensures complete transparency of the entire system.

The main advantages of decentralized finance are:

- speed of transaction;

- security;

- accessibility;

- versatility.

Unlike the traditional financial system, DeFi algorithms process the transaction in a few seconds. This allows you to send and receive money in the shortest possible time. In banks and companies, transactions are carried out by people, which significantly increases processing time. In addition, there is a possibility of error due to the human factor.

It is also worth understanding how blockchain works. When new information is entered, the entire block chain changes. It will not be possible to change or delete it unnoticed, as this will be recorded in the system. This guarantees the security of transactions and eliminates the possibility of fraud that can occur in traditional finance.

DeFi can be used anywhere in the world where there is an internet connection. You can open a bank account only where there is a branch. When using decentralized finance, there is no connection to location or time. Users can manage their funds anywhere and anytime.

DeFi is available for both personal use and corporate accounts. The system can be used to accept payments from all over the world.

The system of decentralized finance is actively used for lending. This is a fairly simple procedure that allows you to get the required amount quite quickly. Unlike the traditional system, where the user needs to collect a huge number of documents, prove solvency, provide a guarantor, and for DeFi it is enough to simply leave an application. You also need to submit an application. Most often, cryptocurrency assets are used for this.

There is also a quick loan service. Unlike a loan, it does not require an outpost. But this service has a significant disadvantage - very short repayment periods. On the other hand, if the user takes out a small amount, it can be returned immediately and interest will not be charged.

Decentralized finance creates an environment where every investor can independently manage their finances. At the same time, users can take part in discussions regarding the further development of the platform. For example, adding new features and designs.

Why is interest in cryptocurrency exchanges growing?

It is important not to confuse decentralized finance and cryptocurrency exchanges. DeFi is a system that allows you to manage money. Cryptocurrency exchanges are platforms for exchanging, buying and selling virtual assets.

Users are increasingly using cryptocurrencies as a payment and investment tool. Some assets have stable growth, which allows you to make a profit. The prevalence of coins makes it possible to establish trade connections around the world and expand the market. In addition, cryptocurrency owners often exchange assets to make money on the difference in value.

Quite often, investors create their own tokens and exchanges. This allows you to ensure stable operation of many systems, quickly carry out transactions and reduce the burden on staff. All this significantly improves the company’s performance. In addition, the cost of developing a cryptocurrency exchange may not be high, especially if you do not need a large number of functions.

Separately, it is worth noting the anonymity of cryptocurrency. Determining exactly who and how many coins sent or received is almost impossible. Therefore, many use virtual assets to protect their savings.

Decentralized finance is a system that includes a huge number of functions. Cryptocurrency exchanges are platforms with relatively limited functionality. On some of them you can not only conduct exchange transactions, but also store coins. But you should understand that the exchange will not provide an ideal level of safety for your savings. Therefore, users use virtual cryptocurrency wallets for storage, and the exchange is a tool that allows them to operate with assets.

How DeFi and Crypto Exchanges Could Change the Financial Industry

Integrating DeFi into the traditional financial system could radically change the industry. First of all, the workload on staff can be significantly reduced. Algorithms that are used in decentralized finance will be able to speed up transactions. Plus, this will significantly reduce the likelihood of errors due to the human factor.

The blockchain on which cryptocurrency exchanges operate is already actively used for storing data. This system allows you to structure data. Accordingly, the amount of paperwork will be significantly reduced, and the need for a large number of archives and documents will disappear. The affordable cost of developing a cryptocurrency exchange makes this easy to do.

Some banking systems already work with cryptocurrencies. This allows users to exchange virtual assets for fiat funds without registering on cryptocurrency exchanges.

Decentralized finance offers many opportunities that will change not only the perception of traditional finance, but the entire industry entirely. For example, lending will become easier and more accessible to more users. Thanks to accessibility, businesses can expand their influence and accept payments from customers around the world.