Shadow system definition

The shadow system is a grid trading system developed originally for forex. It is a statistical method that forms the backbone of successful scalping strategies. Like with any grid, the basic tenets of the Shadow System are “buy low, sell high”. Duh.

Why a “shadow” system

The name itself gives a hint: The shadow system is based on price action and perception, not on indicators or historical data.

There is no numeric value which you watch constantly - but there are “shadows”, or patterns which you will learn to recognize.

This is the key difference to all other approaches, which are based on indicators or an own developed system of rules - shadow system is flexible and agnostic with regard to all this.

Shadow system is being used with basic 1D candlestick charts which are familiar to anyone who reads this website.

If you are interested, here is the original Shadow System post still available on Forex Factory.

What is the theory behind the shadow trading grid?

- Every day, crypto prices go up and down. There is an open price, a high, and a low every day - the close is the same as next day’s open.

- It is rare that the open price is also the high or low of the day.

- Additionally, the daily price action goes very rarely only in a single one direction.

In forex, single-direction days occurs only 1% or less of the time.

Crypto trades differently, but it still holds that the single direction days only happen rarely.

You will have noticed that if you trade with 1D fixed volume profiles.

Figure 1: Single direction trading days are rare.

Usually, there is a “shadow”, or tail, from the open to the high or low of the day. This means that almost every day, there is some action on both sides of the open price.

The Shadow system takes advantage of the small shadow that exists between the open price and the high or low of the day, and scalps a fixed amount of that movement every day.

It is a low-risk (with stops), high-probability mechanical scalping system that in its most basic form disregards trends, indicators, interest calculations, and so on. The only factors that count in this system are daily price action and odds.

The Setup: Running the Shadow System

The setup:

- Enter market at open. Start with the direction that has higher probability in your current market.

- Set your take profit and stop. If you use a regular stop, you might have it moved into profit when possible.

- Once either take profit or stop are hit, reverse the trade direction. Again use take profit and stop loss.

- If you end up with an open position that did not trigger any order, close it near the end of the trading day.

- Rinse and repeat….(Or, you know, maybe a bot could do that)

The tools:

You can trade on this directly from any exchange as there’s no TA-heavy charting involved.

As for automation - This is a rigid scalping strategy, so unless you’re already using a third-party trading bot like Coinrule, there’s no need to buy one. This can be automated using the FTX Quant Zone. See the grid bot article for templates and recipes.

Does it work?

So, before I dump the numbers and spreadsheets on you:

Is the shadow grid actually profitable in crypto?

The answer is yes, but it is less profitable than in forex.

The Data: How well does it work?

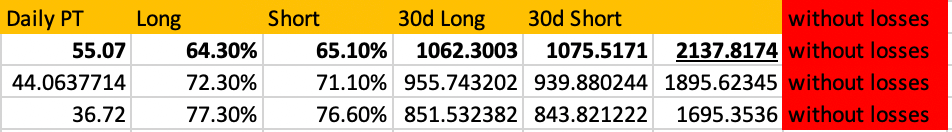

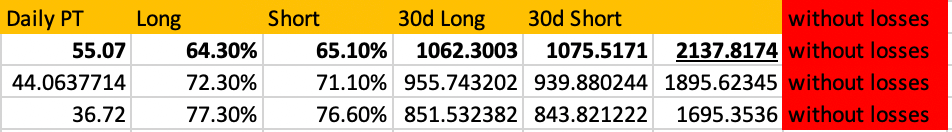

Here is the best-case scenario from my backtest of the shadow system on the ETHUSD pair.

- The shadow system works with take-profit orders in fixed USD distance from the open price. (More on that in the next section.)

- Using the original take-profit formula made for forex, you only get your take-profit filled in ~65% of your trades. (Figure 2: First row) In forex, the rate tends to be over 70% for both sides.

- If you try to set your take profit smaller, you get right more often, but the total profit will be lower - because you are taking smaller profits. (Figure 2: Second and third row)

Figure 2: Best-case scenario of ETHUSD (2021-22 OHL data)

The red notes on the right side signify that this is the best possible monthly profit. It assumes that you never get stopped out.

I didn’t backtest how many times you would actually get stopped out on the same dataset, so what comes next is for illustration only.

Obviously, a lot depends on how loose your stop loss will be. I think we all agree that not setting any stop loss in crypto is a bad idea. But some traders like to set up only a catastrophic stop loss - quite loose - while others like to trail their positions with tight stop losses.

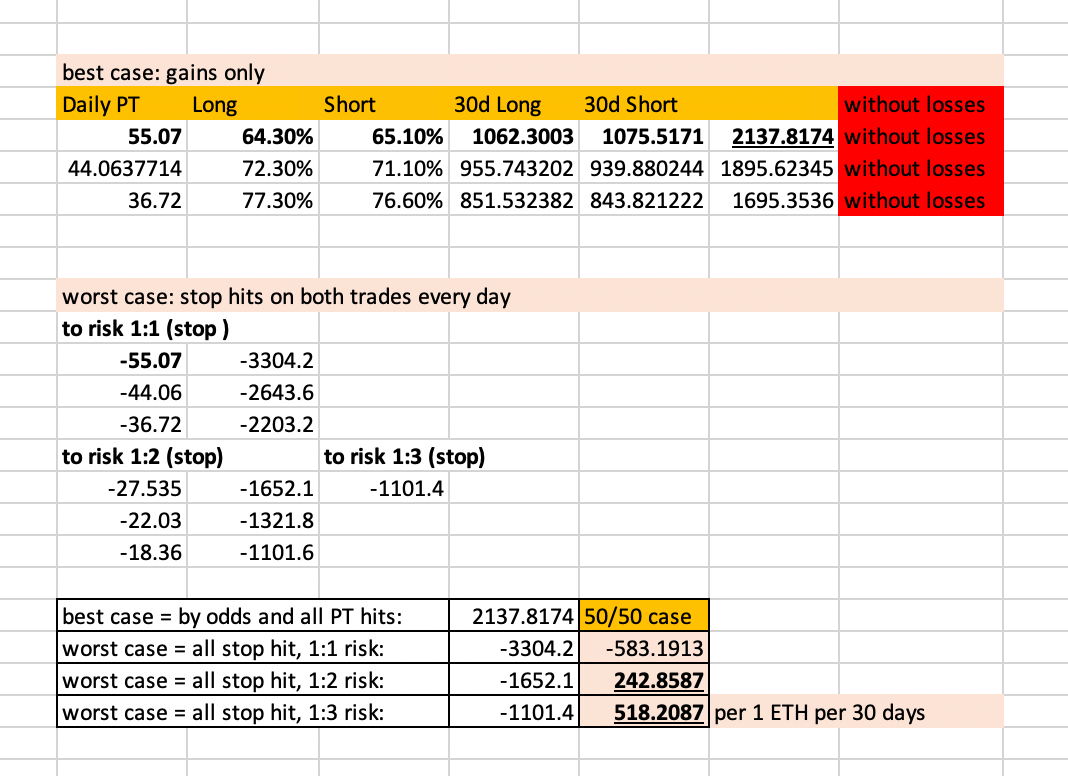

50/50 for a realistic illustration

Anyway, to test out some more realistic outcomes, I used the common risk-reward ratios - 1:1, 1:2, 1:3 - and got the worst-case scenarios.

The worst-case scenario assumes that you will be stopped out every day twice (on your long and on your short).

So, the real monthly profit will lay somewhere between the best case and the worst case.

To illustrate that assumption, I calculated the hypothetical profit for a 50/50 case: You get stopped out in half of the trades.

I got comparable results on ETHUSD as well as on BTCUSD:

- The 50/50 shadow grid is not profitable for 1:1 risk-reward ratio. In forex, it is plenty profitable even with that R/R, but not in crypto.

- The 50/50 profits for 1:2 and 1:3 risk-reward setups are between 9-19% a month on the fiat pairs.

- The ETHBTC ratio had worse results than the fiat-based markets.

Figure 3: Worst-case and 50/50 data for ETHUSD Shadow grid (2021-22 OHL data)

So, it is not bad for something you can automate but it’s not like it’s going to make you a life-changing amount of money if you trade with 50 bucks.

If at least some crypto markets will over time get more rangey and crabby as their regular way, then the expectation is that the shadow grid will get more profitable in the years to come.

The Works: Setting up your shadow grid

In the original shadow scalping system, you work with take-profit orders.

To know where to set your take profit, the shadow system doesn’t use technical indicators. It works with the average daily difference between the daily highs and daily lows.

To get the daily data on your market of choice, you can get the 1D OHL CSV for free on Nasdaq Data, formerly known as Quandl.

I backtested the BTCUSD, ETHUSD and ETHBTC markets, getting the historical Bitfinex daily OHL data for Excel.

-

Relative vs absolute values

Right off, I’ll say that for simplicity’s sake I’m using the absolute base currency values in this post. All amplitudes and price differences of ETHUSD and BTCUSD datasets are calculated in plain USD. I am using only recent 2021 data, where prices kept an even level.

You should at least test the relative values, but I will explain the problem that happens in crypto.

What I tested:

- price differences relative to that day’s close

- price differences relative to that day’s middle

- price differences relative to that day’s open

- price differences relative to the average close over the whole period

On 2021 BTCUSD data as well as on the full dataset since 2014, the best results came from prices divided by the daily close. The thing is, even with prices divided by daily close, the daily take-profit target calculated from the amplitude became much smaller, which made for an overall smaller monthly profit.

Using relative values over a recent range (2021 only) gave the best results…At least on paper. The maximum expected profit over 30 days was about 2.3% better than what gave the setup with plain dollar prices.

Now, for the actual formulas.

-

Daily amplitude

For each market, you first determine the average daily amplitude, which is calculated as half of high-low range for the day.

Daily amplitude tells us on average how much the price moves into extremes each day.

From how much data do you calculate the amplitude?

Well, the daily amplitude will make your take-profit target for each day, so in forex you would naturally want to calculate it from as much data as possible.

In crypto, you will need to use some sense. Cryptocurrencies have appreciated too much over the years that you will probably not get good data applying on today’s market data from prehistoric times when 1 BTC was 300 USD.

In this strategy post I’m using only data from 2021 when the price was at a similar level as in the time of writing.

-

Daily profit target

Your daily profit target is half of the average daily amplitude according to the original shadow grid formula for forex. (It is half of the amplitude because tHaT’s WhErE iT gIvEs rEsUltS. Welcome to scientific trading.)

As already mentioned once above, you can make the take-profit smaller and be right more often, but in this case that leads to smaller monthly profit overall.

-

Verify that the system makes sense

You should always compare the value of the amplitude with the average values for open-high, open-low, and open-close ranges.

The amplitude should not be too far from the average absolute value of all three of those ranges.

If the ranges mutually differ a lot, it means the market is not a good fit for the basic shadow system strategy without the use of technical indicators. You will probably have better results by trading a trending grid there, or using some other technical setup.

-

Backtesting the shadow grid

The idea behind shadow system is sound, but the 1 BTC question is whether it is profitable. With a rigid grid system like this, it’s not too difficult to backtest the extreme outcomes using the the OHL datasets that you already have.

So, by now you have a daily profit target distance that seems to make sense.

In the shadow grid system, you will use it to take profits at that distance from the daily open price.

- On ETHUSD, we came up with a profit target of about 55 USD.

- The daily long side take-profit order will be set at

open price + 55 - The daily short side take-profit order will be set at

open price - 55

To backtest the system, you want to take the distance of the open vs the extremes of your market - your daily high and low - and count how often they will cover your calculated profit target.

To get this in Excel, count the days where the

open-high distance…

…is a higher absolute number than

take profit distance.

That’s how you get the statistical percentage for how often your shorts and your longs will be hit.

If at least one of the sides comes at above 50%, you have the theoretical odds. In sideways ranging markets both sides should be over 50%.

-

Find out the monthly profit and loss extremes

The best case scenario assumes you make the value of your profit target twice every day.

The worst case scenario assumes you lose the value of your risked amount twice every day.

- In the 1:1 setup, you risk the same amount as is your profit target.

- In 1:2 setup, you risk half of your profit target.

And that’s it for your basic backtest of the shadow grid.

Should you run it?

If you can automate it, it might be worth a shot for prolonged ranges and bear markets.

The real profitability of the shadow grid in crypto is a matter of stop loss management, which is the usual way for scalping setups as you’re only taking small profits. A good stop loss placement is harder to backtest, but your overall profit is bound to improve with it.

Obviously this is not a strategy for trending markets.

Lastly, I know that technical traders probably wouldn’t gravitate towards a strategy like this.

- If you already have a favourite indicator or a TradingView script on which you trade, the best way to see if you’re missing out is to backtest your profits from that script and see if you can make up to 19% a month on that.

If the main thing that interests you on the shadow system is the fact that it can be easily automated, then good news - so can TA.

- It’s easy to automate TA trading on a TradingView script if you have TradingView premium and Coinrule premium - here’s how. And that strategy will probably be more profitable than the shadow system in its basic form as it’s shown here.

But if you don’t trust technical analysis and are willing to do some tuning, then the shadow grid might just work fine for you.

What cryptocurrencies are best for shadow scalping?

If you do want to run this, here’s the market selection note before we end this post.

To trade the shadow grid, you need a crypto market with high intraday volatility - but not an extreme one.

Basically, the list of pairs will be the same as for the best coins for a grid bot: Decent liquidity, capable of ranging, not hype-based.

- BTCUSD

- ETHUSD

- ETHBTC

Obviously, the shadow system as any scalping strategy is good for ranging and crabbing markets.

In small alt coins, meme crypto and any market that is driven by “pump” sentiments, you are actually quite likely to get single direction days.

For intraday scalping, you need a market that moves a lot during the day, but in both directions.

Summary

The shadow system is a scalping grid trading system that takes small profits in both directions every day. Right now, it is not as profitable in crypto as it is on the forex markets. But it is not a bad system for simple, easily automated trading that is not based on any technical analysis whatsoever.

Tools mentioned in this trading strategy: